Switch to payroll you can count on, from ADP®

Why switch to ADP payroll?

Every year, thousands of small businesses leave Gusto, QuickBooks Payroll, Paychex, SurePayroll and others for ADP. See why 4 out of 5 customers who switched from another provider are more likely to recommend ADP.1

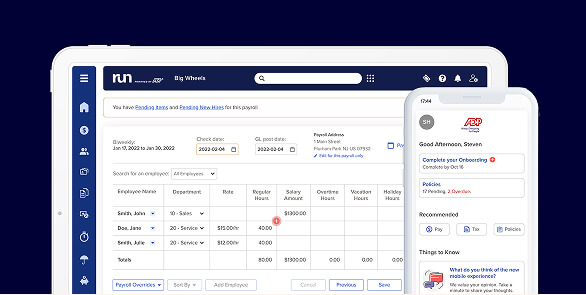

See how easy small business payroll and HR can be

Pay your people in just minutes, with an intuitive platform.

Convenient HR and hiring tools also help you grow and manage your team.

1 Minute Overview

ADP has reimagined what’s possible, to make running payroll and HR better than ever before.

Get more with ADP

Get these tools with ADP, but not with Gusto2

Payroll

- 24/7 live support (Gusto offers only 5am-5pm PT, Mon.-Fri.)

- Advanced State Unemployment Insurance (SUI) management tools (claim responses, benefit payments review, best practices consulting)

- Dedicated new client onboarding support for small businesses of all sizes

- Multi-state payroll, across all bundles

- Pay employees who work in multiple states or local jurisdictions within a single pay period

- Two-day processing cycles for all clients (without assigned direct deposit limits)

- Register with tax agencies in all 50 states (does not require third-party partner)

- Partner app connectors to over 30 leading Point of Sale (POS) solutions

- Single invoice billing that combines ADP payroll and complementary partner services

- Over 75 years of payroll experience

- Rated #1 small business software by G2 in 2025

HR & Business

- Employee handbook wizard, pre-populated for your state/jurisdiction

- Hiring via ZipRecruiter®5

- Job description wizard

- Employee discount program for brand-name products and daily essentials

- Live R&D tax credit consultation to determine credit amount based on your unique business situation

- Analytics (tenure, turnover, hiring) across multiple managed companies.

- Access to free and discounted legal services (provided by third party)3

- Option to outsource to a full-service PEO (Professional Employer Organization)

Get these tools with ADP, but not with Paychex2

Payroll & HR

- Hiring via ZipRecruiter®5

- One-stop partner marketplace, where clients can search, compare, activate and pay for apps (time, HR, accounting & more)

- Salary benchmarks data (to help you make competitive job offers and that can help you comply with pay transparency laws) at no added cost in top-tier HR bundles

- Job description wizard, at no additional fee

- Online employee onboarding across all bundles (no additional cost)

- Single invoice billing that combines ADP payroll and complementary partner services

- New client online onboarding across all bundles (no need to call customer service)

- Register with tax agencies in all 50 states (does not require third-party partner)

- Support from a payroll specialist via phone & email, no additional fee

- Rated #1 small business software by G2 in 2025

- G2 rating peer review 4.5 (of 5) stars or higher

- Over 75 years of payroll experience

- Access to free and discounted legal services (provided by third party)3

Get these tools with ADP, but not with QuickBooks Payroll2

Payroll

- Advanced State Unemployment Insurance management tools (claim responses, benefit payments review, best practices consulting)

- Convenient mobile app for payroll and HR

- 24/7 live support across all bundles

- Dedicated new client onboarding support for small businesses of all sizes

- Register with tax agencies in all 50 states (does not require third-party partner)

- Award-winning (Titan Award, Stevie Award, Globee Award) portal that connects your accountant to your payroll

- General Ledger (GL) mapping with key accounting software’s (QuickBooks, Xero, Sage, etc.)

- Rated #1 small business software by G2 in 2025

- G2 rating peer review 4.5 (of 5) stars or higher

- Over 75 years of payroll experience

HR & Business

- Employee handbook wizard, pre-populated for your state/jurisdiction (no third-party partner required)

- Online courses (and completion tracking) on sexual harassment and abusive conduct, HR compliance, and much more

- Printed labor law posters at no additional fee (QuickBooks charges extra)

- Hiring via ZipRecruiter®

- Applicant tracking system to help manage the end-to-end hiring process

- Background checks for prospective hires

- Access to free and discounted legal services (provided by third party)3

Get these tools with ADP, but not with SurePayroll2

Payroll

- 24/7 live support across all bundles

- Native suite of time tracking tools with scheduling and physical time clocks

- Accounting software integration at no additional fee

- Advanced SUI management tools (claim responses, benefit payments review, best practices consulting)

- Multi-state tax filings at no additional fee

- Robust suite of pre-built reports (SurePayroll only offers nine pre-built reports)

- Partner app connectors to over 30 leading Point of Sale (POS) solutions

- Single invoice billing that combines ADP payroll and complementary partner services

- Robust portal for employees to manage pay information, federal tax withholding, and time tracking

- Rated #1 small business software by G2 in 2025

- Local tax filing (at no additional fee)

HR & Business

- Hiring via ZipRecruiter®

- One-stop partner marketplace (at no additional fee)

- Employee discount program for brand-name products and daily essentials

Making a big difference for small businesses

9/10

customers prefer ADP over their previous payroll provider.

9/10

customers say ADP is the right payroll solution for their business.

9/10

customers get peace of mind with ADP's 24/7 real-person payroll support.

Internal survey of 3,099 RUN Powered by ADP® customers in 2025.

MEET OUR CLIENTS

Our previous payroll provider made too many mistakes, requiring us to double-check their work. That’s a lot of wasted time. With ADP, that’s no longer an issue, and it gives me peace of mind knowing I can trust the service we receive.

Mark Picillo General Manager, United Check Cashing

MEET OUR CLIENTS

We wanted a payroll and HR solution that would streamline onboarding and also have great support. ADP provides a great value for the services offered. We chose ADP over Paycor when their prices began to go up.

Summer Hawks Executive Director, Greater Dayton Volunteer Lawyers Project

MEET OUR CLIENTS

So far, everything I have experienced with ADP has been fantastic. We came from another HR platform, and it was horrendous. ADP made it super easy to transition and every step of the way, every need has been met. Customer service is super knowledgeable, helpful and efficient. And the platform itself is very user friendly. Super happy.

Laura Rivera HR Director, Vision VMC

Join over 900,000 small business clients who count on ADP for faster, smarter, easier payroll and HR

Get PricingADP delivers more for your money and 24/7 service

When you’re considering a switch, ask yourself: what am I really paying for? With ADP you get:

- Help with compliance challenges

- A simple set up

- A hassle-free process for running payroll

- Comprehensive HR services as you grow

- 24/7 support — even outside normal business hours

User satisfaction ratings

See how customers rated ADP on G2, a leading business software review platform, in the categories that matter most.4

Likelihood to Recommend

Payroll entry

Performance and reliability

Ease of use

Tax Calculation

Ease of Admin

Get valuable HR tools included

only with RUN Powered by ADP®

With RUN's premium HR package option, you will receive features that go above and beyond what you get with other providers. Customers get an average of $8k per year in added value with HR services that help them keep their businesses growing, hire new staff, train their teams, and much more.

- Access to ZipRecruiter® hiring platform and ADP salary benchmarks

- Employee assistance program and perks

- Employee HR training

- Business and marketing tools

- Legal assistance from Upnetic Legal Services3

Payroll compliance made easier

Keeping up with constantly changing labor laws is a full-time job on its own. That’s why ADP built solutions to help you stay compliant. But don’t just take our word for it — nearly 4/5 customers feel ADP helps their company better comply with payroll taxes and regulations than their previous provider.1

Unlike many of our competitors, who only dabble in payroll, we do it all:

- Compliance: Get help complying with regulations with ADP’s labor law poster compliance update service

- Garnishment payment services: Effectively manage your wage garnishment processing

- Tax filing: We calculate, file, deposit and reconcile your payroll taxes

- Hiring: Get help finding the right candidates with ZipRecruiter® - now included with RUN Powered by ADP

Top FAQs about switching

- How much time will the transition take?

-

How quickly you switch to your new provider depends on your company’s priorities, the services you’re using and how quickly you can access the required data. With ADP, some customers can be up and running within 2 days, while others choose to make the transition over a period of weeks. Services beyond payroll may take longer to set up. Regardless, a well-done transition should never disrupt your payroll process.

- Does it matter what time of year I start?

-

Though some people prefer to wait for the start of a new quarter, or even a new year, before switching over to a new payroll service provider, ADP can support your move at any time. Any high-quality provider should be able to give you a clear list of forms and information you’ll need to make a smooth transition.

- How much time should I expect to spend on payroll with a service provider?

-

If you’re doing payroll manually now, you should expect to significantly reduce the amount of time you’re devoting to the process. How much depends on which services you choose. Do you want help tracking time and attendance? Assistance with background checks or employment verifications? Check signing and stuffing? An ADP representative can explain your options and help you choose the package that best fits your business.

- How much does all this cost?

-

Different payroll providers offer different pricing structures, but certain factors — how frequently you run payroll, how many people you’re paying, how often you add or remove payees, which services you need — will influence the cost. ADP will work with you to determine the right payroll set-up for your business, no matter how simple or complex your needs are.

- What if I need help, especially before or after business hours?

-

When you hit a snag with payroll, you can’t wait days for someone to get back to you with the right answer. RUN Powered by ADP® offers direct access to experienced payroll professionals available 24/7. Clients can also email questions to the Payroll Center at any time.

- How do you pay employees when a disaster strikes?

-

ADP products are in the cloud, (built on a secure, redundant network), and allows our clients to pay their employees, regardless of what’s going on locally. Through additional services, ADP can help you manage leave during and after a disaster and advise you on benefits, policies and programs to help your employees recover.*

- What are the different employee payment options?

-

From physical checks to direct deposit, when it comes to distributing wages, today’s employers have more — and smarter — choices than ever before. Talk to an ADP representative to see which one is the best fit for your business and employees.

- As an accounting professional, how can I switch my clients to ADP payroll?

-

It is very easy to refer your clients to ADP’s payroll and HR platforms with Accountant ConnectSM – ADP’s free platform designed by accountants for accountants to access their authorized clients’ payroll data, analysis tools, the latest tax resources from Wolters Kluwer CCH Resource Library, and much more. To sign up or login, visit adp.com/accountantconnect. After you login, select “refer a client”, enter your client’s information and your dedicated ADP Representative will reach out to begin the process.

Your privacy is assured.

- Internal survey of 2,099 RUN Powered by ADP® customers in 2025 who previously processed payroll with another provider.

- Information based on ADP internal research and is accurate as of October 7, 2025 and is subject to change.

- Legal services are provided by Upnetic Legal Services powered by Legal Club® (of America), a third-party provider.

- G2 user review data from September 30, 2025.

- ZipRecruiter is a registered trademark of ZipRecruiter, Inc.

*Insurance products will be offered and sold only through ADPIA, its licensed agents or its licensed insurance partners; 1 ADP Blvd. Roseland, NJ 07068. CA license #0D04044. Licensed in 50 states. All services may not be available in all states.

ADP, Inc. and its affiliates do not offer investment, tax or legal advice to individuals. Nothing contained in this communication (or website) is intended to be, nor should be construed as, particularized advice or a recommendation or suggestion that you take or not take a particular action. ADP, Inc. and its affiliates are not affiliated with Gusto, Paychex, QuickBooks Payroll or SurePayroll.

ADPIA is a registered trademark of ADP, Inc.

.png?rev=e31bfdc9ccc74b2db392d4b39a46309a&hash=D33A1C02E90411048BCA05A03233D3D7)