Financial wellness

Improve the productivity of your workforce by giving them the tools to support their financial well-being.

Empower employees with financial wellness

Financial wellness comes from financial literacy combined with innovative tools that help employees to get the most from every dollar — today and in the future. When you improve employees’ financial well-being, they may be more efficient at work—and you will be positioned to retain and attract talent. Wisely features support employee financial wellness.

Employee financial wellness is a competitive advantage

Financial stress hurts worker productivity — which can cost your company.

59%

of employees say that financial concerns cause them the most stress in life8.

35%

of employees say that financial concerns have been a distraction at work8.

3 hrs/week

is the average time employees spend thinking about financial concerns8.

Wisely makes it easy for employees to:

Map their future

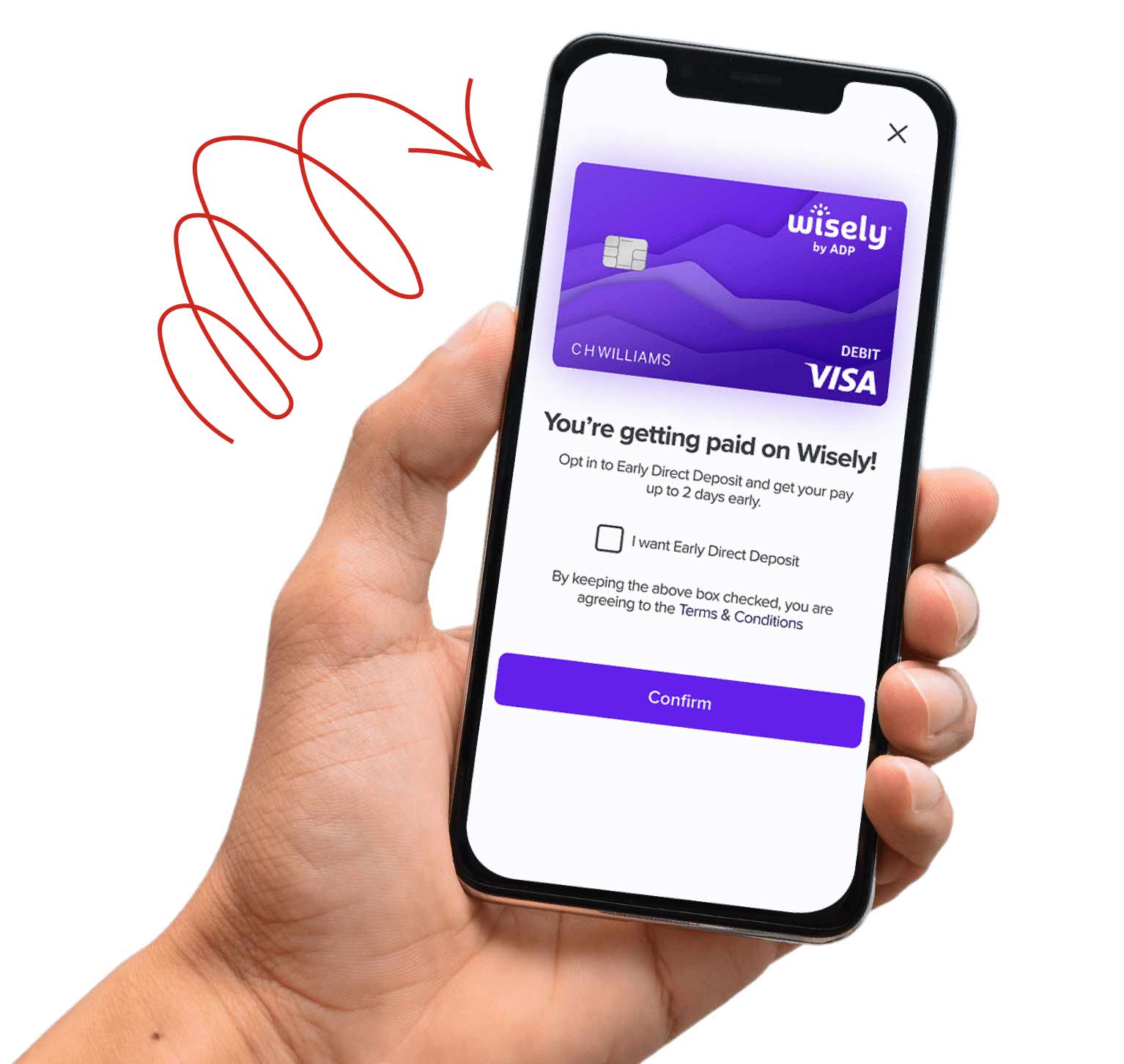

- Early direct deposit

- Companion cards

- Rewards program6

- Member perks

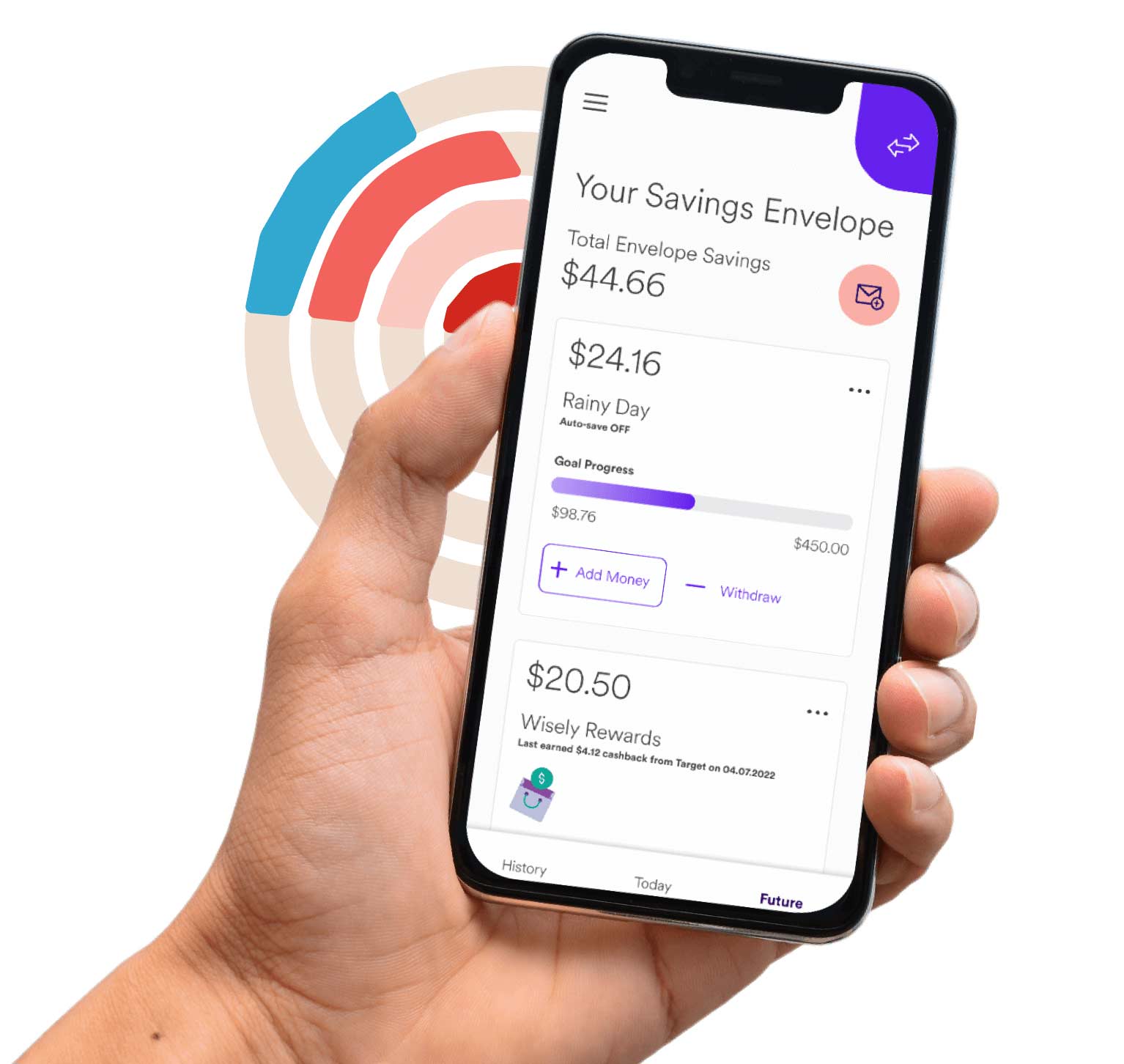

- Savings10 tools

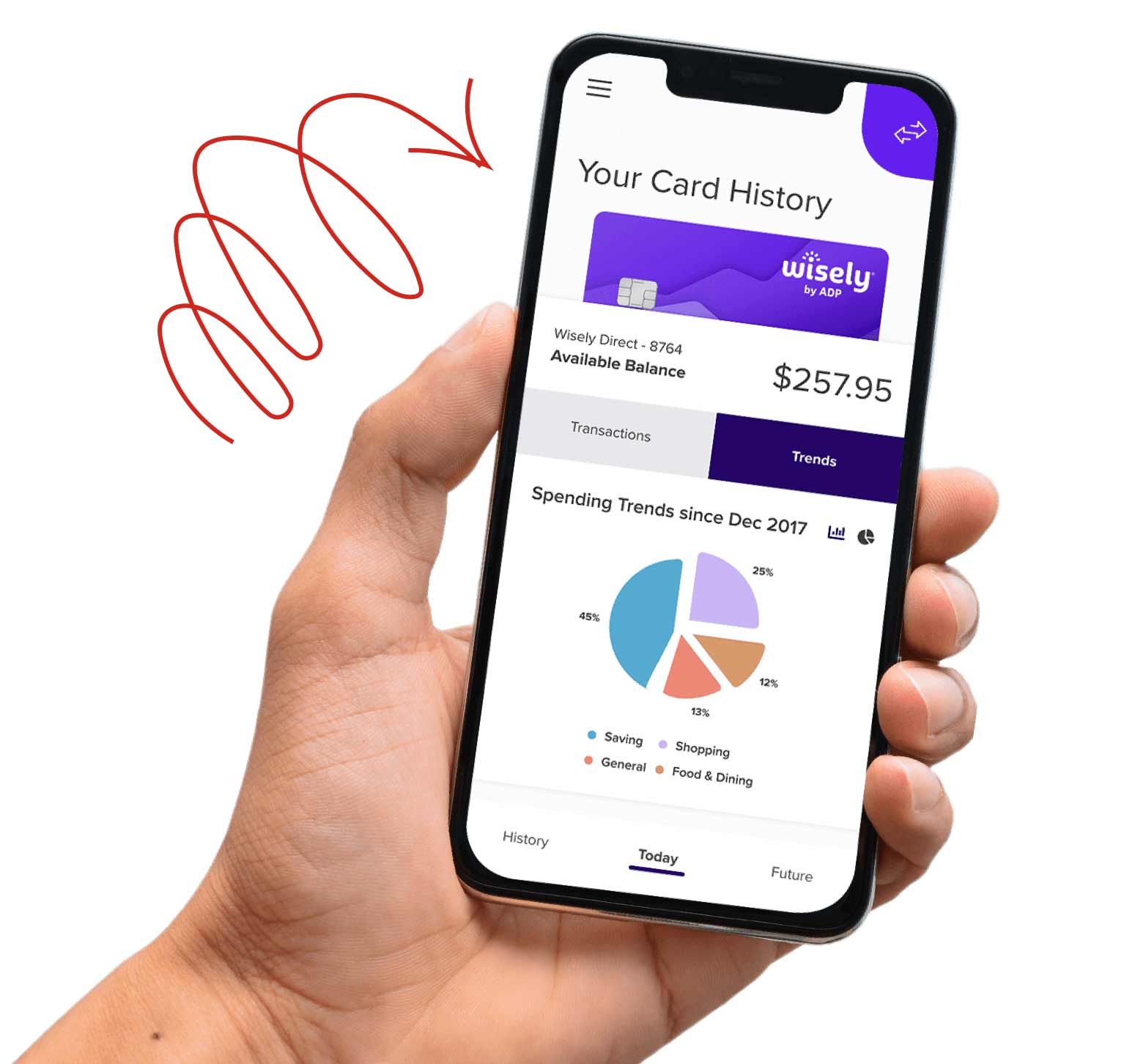

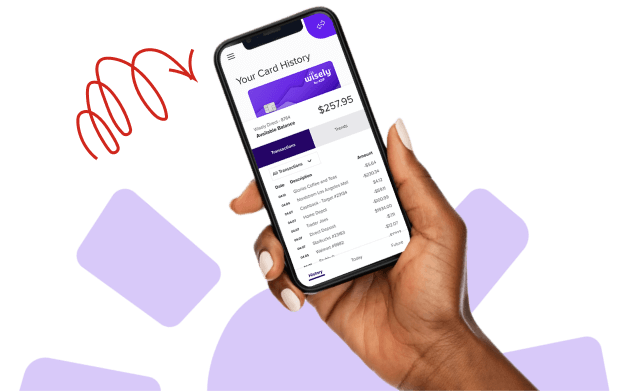

- Spending trends

Secure their funds

- Travel protection

- Card lock

- Biometric security

- Instant notifications

- Multi-factor authentication (MFA)

Manage their money

- Bill pay

- Money transfers

- Check load7

- Cash access3

- Virtual card access11

1. https://juno.finance/blog/bank-fees

2. Because this card is prepaid, you can only spend what is on the card and thus are unable to overdraft.

3. The number of fee-free ATM transactions may be limited. Please log in to the myWisely app or mywisely.com and see your cardholder agreement and list of all fees for more information. Standard message and data rates may apply.

4. You must log in to the myWisely app or mywisely.com to opt-in to early direct deposit. Early direct deposit of funds is not guaranteed and is subject to the timing of payor’s payment instruction. Faster and easier access to funds is based on comparison of traditional banking policies and deposit of paper checks versus deposits made electronically and the additional methods available to access funds via a Card as opposed to a paper check. If you have a Wisely Pay or Wisely Cash card (see back of your card), this feature requires an ID verification which may not be available to all cardholders.

5. The bill pay feature, powered by Papaya, is available through the myWisely app. Additional terms and limits apply. This optional offer is not a Fifth Third Bank or a Mastercard or Visa product or service, nor does Fifth Third Bank, Mastercard or Visa endorse this offer.

6. eGift Card cash back offers are powered by Blackhawk Network and range from 2% - 12%, depending on the gift card that is purchased. Cash Back amounts will be disclosed before you select a gift card. Please review the Terms and Conditions of each eGift card product before purchase. Funds from all Rewards can be moved from the Wisely Rewards savings envelope into the available balance on your card. You must log in to myWisely to access the Rewards feature for eGift cards. These optional offers are not a Fifth Third Bank, Mastercard or Visa product or service, nor does Fifth Third Bank or Mastercard or Visa endorse this offer.

7. Additional terms and third-party fees may apply. Please log in to the myWisely app or mywisely.com to see your cardholder agreement and list of all fees for more information.

9. To view applicable fees, please log in to the myWisely app or mywisely.com to see your cardholder agreement and list of all fees for more information.

10. Amounts transferred to your savings envelope will no longer appear in your available balance. You can transfer money from your savings envelope back to your available balance at any time using the myWisely app or at mywisely.com.

11. The virtual Wisely paycard option, when enabled by an employer, will allow employees to access cash or make purchases with their Wisely account prior to receiving their physical card.

12. Standard message and data rates may apply.

The Wisely Pay Visa® is issued by Fifth Third Bank, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc. The Wisely Pay Mastercard® is issued by Fifth Third Bank, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. The Wisely Direct Mastercard is issued by Fifth Third Bank, N.A., Member FDIC. ADP is a registered ISO of Fifth Third Bank, N.A. The Wisely Pay Visa card can be used everywhere Visa debit cards are accepted. Visa and the Visa logo are registered trademarks of Visa International Service Association. The Wisely Pay Mastercard and Wisely Direct Mastercard can be used where Debit Mastercard is accepted. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Apple, the Apple logo, and Apple Pay are registered trademarks of Apple Inc. App Store is a service mark of Apple Inc., registered in the U.S. and other countries. Apple and iPhone are trademarks of Apple Inc. Google Play and the Google Play logo are trademarks of Google Inc.

ADP, the ADP logo, Wisely, myWisely, and the Wisely logo are registered trademarks of ADP, Inc. Copyright © ADP, Inc. All rights reserved.