Table of Contents

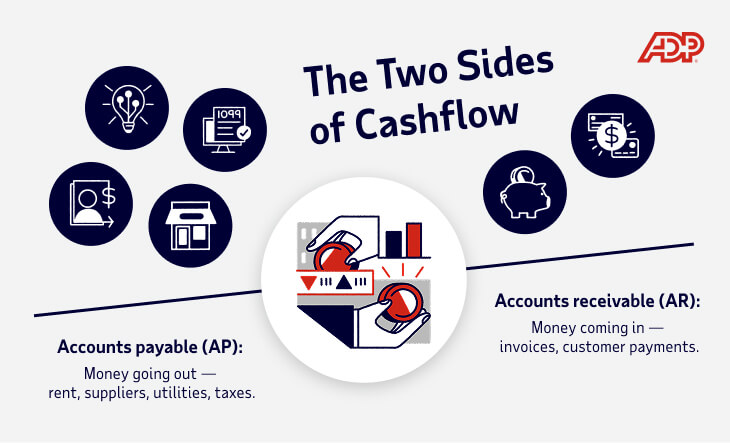

Every business owner knows payroll is critical. But just as important—and often overlooked—are the systems that manage the flow of money in and out: accounts payable (AP) and accounts receivable (AR).

For small businesses, AP and AR are not abstract accounting terms. They determine whether bills get paid, customers pay on time and there’s enough cash available to keep the business growing. When managed well, AP and AR create stability and breathing room. When neglected, they lead to late fees, strained relationships and unnecessary stress.

Consider a coffee shop owner. Each month, they pay suppliers for beans and pastries, but they also wait for catering customers to settle invoices. If they pay suppliers too quickly while customers delay, they risk a cash crunch. If they time it right, they can build reserves, invest in equipment and expand.

What are accounts payable and receivable?

Accounts payable (AP)

AP represents the money that goes out of a business, typically owed for goods or services it has already received but not yet paid for. These are short-term obligations recorded as liabilities on the balance sheet. Common AP items include:

- Rent and utilities

- Supplier invoices for inventory or materials

- Employee reimbursements

- Taxes and subscription fees

Managing AP effectively means timing payments so that cash remains available for operations without risking late fees or damaging supplier trust. For small businesses, this balance can make the difference between steady operations and sleepless nights.

Accounts receivable (AR)

AR is the money owed to a business by its customers for goods or services already delivered but not yet paid for. It appears as a current asset on the balance sheet. Examples include:

- An outstanding invoice from a catering client

- A contractor billing for completed design work

- Credit sales made at a retail store

Strong AR management helps cash come in on time, supports liquidity and strengthens customer relationships by setting clear expectations.

Why they matter together

AP and AR are the push and pull of cashflow. AP reflects money going out, and AR represents money coming in. Together, they determine whether a business operates reactively or with strategic foresight.

The challenges small businesses face

1. Accounts payable headaches

For many small businesses, AP is still handled manually: paper invoices, handwritten checks, spreadsheets. Manual processes can open you up to challenges:

- Late payments can trigger fees and hurt vendor relationships

- Human error, like duplicate payments or incorrect amounts

- Missed opportunities for early-payment discounts or better terms

- Increased risk of fraudulent invoices or a lack of visibility into upcoming bills

From a late payment to a duplicate check, each slip in AP can put vendor relationships and cash reserves under strain.

2. Accounts receivable frustrations

On the AR side, the biggest issue is timing. Small businesses often wait 30–90 days for payment. Challenges include:

- Late-paying customers, forcing owners to cover expenses with credit

- Unpredictable inflows, which make planning difficult

- Disputes over invoices, which delay payments and strain customer relationships

- Credit risk, when extending terms to new customers without assessing reliability

The result is constant uncertainty: money owed on paper may not arrive when it’s needed, creating stress and forcing owners to juggle expenses.

3. Fragmentation across systems

Many businesses use one tool for payroll, another for bills, and a separate process for invoicing. The result is:

- No consolidated view of finances

- Time wasted reconciling across platforms

- Increased risk of errors and oversight

With payroll, AP, and AR in separate places, it’s hard to understand the true state of cashflow, making surprises on payday more likely.

Match money in with money out

Stay ahead of cash crunches by managing payroll, bill pay and invoicing in one platform.

Why connecting AP and AR matters

Imagine a design agency that pays contractors immediately upon invoice but waits 45 days for clients to pay. The result is a recurring cash shortfall. Now imagine the same agency staggering vendor payments to align with client collections. Suddenly, the cash crunch eases.

For small business owners, the difference between crisis and control often comes down to whether AP and AR are connected. Having a centralized system to manage both creates:

- Predictability – Matching outflows with inflows helps reduce stress

- Visibility – A single dashboard shows upcoming bills and incoming payments

- Control – Owners can make decisions with real-time information rather than guesswork

That clarity turns cashflow from a guessing game into a manageable plan.

Trends reshaping AP and AR

Digitization and automation

Manual processes eat up hours and increase errors. For small businesses, digitization means:

- Invoices upload automatically

- Payments can be scheduled in advance

- Reminders go out without manual follow-up

- Errors are reduced through automated reconciliation

This shift can lighten the workload and help prevent avoidable errors.

Payment flexibility

Customers want to pay with cards or digital transfers. Vendors often prefer ACH, checks or faster settlement. Meeting vendors and customers where they are builds goodwill on both sides.

Integrated workflows

Modern platforms are broadening their scope, extending AP and AR alongside payroll, bookkeeping, and tax tools. Bringing these capabilities into the same ecosystem helps business owners spot patterns in money coming in, money going out and what’s left for their team.

Data-driven insights

AP and AR data is a goldmine. With it, small businesses can identify:

- Customers who consistently pay late

- Opportunities for early-pay discounts from suppliers

- Spending patterns that affect margins

With the right data, small businesses can spot patterns early and act before small issues become a liquidity crisis. When AP and AR are digitized, they become tools for strategy, not just recordkeeping.

The business case for modernizing AP/AR

The return on modernization is clear:

- Efficiency – Automated AP/AR reduces manual workload

- Cost savings – Avoid late fees, capture discounts, reduce processing costs

- Liquidity – Align payables with receivables to optimize working capital

- Stronger relationships – Paying vendors simply and reliably can build trust

- Peace of mind – Fewer surprises and more time to focus on growth

For small business owners, modernization is key to survival and scalability.

Get one clear view of your cashflow

See what’s coming in and going out with ADP Small Business solutions.

Best practices for small business leaders

- Enter bills and invoices as soon as you receive them

- Automate reminders

- Pay vendors strategically

- Offer flexible payment options

- Track key metrics

- Review AP and AR holistically

1. Enter bills and invoices as soon as you receive them

Delays in entering bills can lead to missed deadlines and surprise expenses. Filing immediately creates visibility and helps prevent mistakes.

2. Automate reminders

Chasing payments is uncomfortable. Automated reminders handle the follow-up with professionalism and consistency, helping to reduce overdue invoices.

3. Pay vendors strategically

The goal is balance: pay on time but not prematurely. Preserving cash until it’s needed improves liquidity without risking trust.

4. Offer flexible payment options

Make it easy for customers to pay in the way they prefer, whether that’s ACH, credit card or a digital link.

5. Track key metrics

- Days Sales Outstanding (DSO): How quickly you collect from customers

- Days Payable Outstanding (DPO): How long you take to pay vendors.

Tracking both together helps align cash in and cash out.

6. Review AP and AR holistically

Reviewing AP and AR side by side each month (alongside payroll) helps owners to see the full picture of their businesses’ cashflow.

The future of AP and AR

Accounts payable and receivable are moving from being recordkeeping tasks to becoming real-time, intelligence-driven functions. Several shifts are shaping what’s next for small businesses:

- Faster payments

Waiting days for checks to clear or transfers to settle will become less common. As real-time payment networks expand, businesses will gain quicker access to funds, helping smooth cashflow and reduce reliance on credit. - Smarter forecasting

Advances in data and automation will make it easier to predict when money moves in and out. Knowing which customers regularly pay late or when seasonal expenses spike allows owners to anticipate cashflow issues before they happen and plan accordingly. - Embedded finance

Instead of toggling between separate systems, AP and AR will increasingly live inside the platforms businesses already use, like payroll, HR, and accounting software. This integration helps reduce complexity and gives business owners one clear view of their finances. - Data-driven insights

AP and AR data offer more than forecasts. They guide strategic choices such as which vendors to prioritize with early-pay discounts, where hidden costs are appearing and when reinvestment is safe.

The bottom line

Small business owners didn’t start their companies to chase invoices, shuffle bills or stress about payday. Yet those back-office functions decide whether they have the breathing room to serve customers well, invest in their team or make the next smart move. When payroll, AP and AR are connected, owners can stop firefighting and focus on running their business with clarity and confidence. That’s the kind of shift that can help owners build the business they imagined when they started.

Explore Learn more about ADP’s AP and AR solutions for small businesses/a>

Frequently asked questions about accounts payable and accounts receivable

What is the difference between accounts payable and accounts receivable?

Accounts payable (AP) is money your business owes suppliers for goods or services already received, shown as a liability on the balance sheet. Accounts receivable (AR) is money customers owe you for sales made on credit, listed as an asset. Together, AP tracks outflows while AR tracks inflows, and both determine whether your cashflow is stable or strained.

How can small businesses manage accounts payable more effectively?

File invoices as soon as they arrive, schedule payments close to due dates, and use AP automation to help reduce errors. Negotiating terms, like early-pay discounts or extended timelines, helps protect liquidity while maintaining strong vendor relationships.

What are the biggest challenges with accounts receivable?

The main issue is timing, with payments often delayed 30–90 days. Late payers and unpredictable inflows make planning hard. Automated reminders, flexible payment options, and clear credit policies can help speed up collections and strengthen customer relationships.

How do accounts payable and receivable impact cashflow?

If AP goes out before AR comes in, cashflow problems follow. Aligning outflows with inflows, for example, staggering vendor payments to match client collections, creates a predictable cashflow and reduces reliance on credit.

Why are accounts payable and receivable important for small business growth?

Managed poorly, AP/AR can cause late fees and strained relationships. Managed well, they build trust with vendors, make it easier for customers to pay, and free up cash for investment. Strong AP and AR processes give small businesses the stability to operate with confidence today and the flexibility to grow tomorrow.

Ready to simplify your cashflow management?

Cashflow chaos can kill momentum. ADP’s small business solutions unite payroll, bill pay and invoicing in one platform, giving you clarity and control so you can stay focused on growth.

Want more exclusive business insights like this delivered to your inbox?Subscribe now