insight

ACA Compliance Requirements, Reporting & Guidelines

Ready to take a proactive approach to ACA compliance?

The Affordable Care Act (ACA) was designed to encourage employers to provide timely, affordable and appropriate health benefits to eligible employees. While this may sound basic in principal, it’s really just the tip of the iceberg. In order to provide the right benefits, at the right time and to the right employees, employers must obtain and maintain accurate data. Tracking and reporting this information is a large part of complying with the ACA and avoiding costly penalties from the IRS and applicable state agencies.

Table of Contents

What is ACA compliance?

Businesses that are subject to the ACA must offer affordable health insurance that provides minimum essential coverage and minimum value to at least 95% of their full-time employees (including dependents). They’re also required to provide employees with the following information:

- Notice of coverage and available benefits

- Summary of Benefits and Coverage (outlines offered plans and employee cost)

- Form 1095-C, Employer-Provided Health Insurance Offer and Coverage (annual confirmation of offered benefits)

In addition, Forms 1094-C/1095-C must be filed with the IRS and all applicable state agencies each tax year, confirming that timely, affordable and ACA-compliant coverage was offered to eligible full-time employees every month. Data and business practices should be aligned so that these forms present accurate and complete information. Otherwise, the IRS and state agencies may issue penalty notices.

Who must comply with the ACA?

The ACA applies to applicable large employers (ALEs), which are businesses that had 50 or more full-time and full-time equivalent (FTE) employees on average during the previous year. When determining full-time status, it’s best practice to measure all employees within an organization because traditional HR status does not always reflect ACA benefits eligibility.

Note that businesses with multiple federal employer identification numbers (FEINs) are not counted separately, but are considered parent and child organizations. For more information, employers should refer to the following IRS resource: Determining if an Employer is an Applicable Large Employer.

Explore Learn more about ADP's ACA compliance solutions

ACA compliance requirements

According to ADP observations, four of the most challenging ACA compliance requirements are determining employee eligibility, confirming affordability, reporting data and responding to penalty notices.

Determining employee eligibility

ALEs are required to provide health insurance to at least 95% of their full-time employees, as well as the dependents of those employees, or they may be subject to penalties. For purposes of the ACA, a full-time employee is anyone who, on average, works 30 hours or more per week or 130 or more hours per month.

Employers need to continually track which members of their workforce fulfill this criteria and whether they accept or decline health coverage. Proper tracking means understanding not only hours worked as classified by the ACA but also monitoring other actions, such as leaves of absence. An integrated compliance solution like ADP SmartCompliance for Health Compliance can help you automate this tracking by retrieving data from your payroll. HR or benefits systems (even if you don’t use ADP for payroll & HR).

Gathering the required information regularly, accurately and in a timely manner can be the difference between potentially receiving an IRS penalty notice and being able to respond and have the penalty rescinded with no remaining liabilities.

Confirming affordability

Under the ACA, an employer-sponsored health plan cannot cost employees more than a certain percentage of their household income. It must also provide a certain level of benefits and value to employees and their covered individuals.

Since most employers won’t know their employees’ household incomes, safe harbor calculations may be used as alternative methods to determine affordability. Traditional safe harbors include W-2 wages, rate of pay and the federal poverty level. The use of other safe harbors depends upon the type of plans offered, i.e., traditional vs. individual coverage health reimbursement arrangement (ICHRA) plans.

Wellness programs and incentives that impact health care costs may also be considered when calculating affordability, as defined by ACA regulations.

Reporting data: IRS and applicable states

Each year, employers are required to file Form 1095-C with the IRS and provide a copy to all employees who were full-time or were enrolled in self-insured coverage for one or more months during the year. This document includes information about the type of health coverage offered, the lowest premium available to each employee, the months of the year when coverage was available, and the months the employee and dependents enrolled in that coverage.

Employers must also file Form 1094-C, Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns, which goes to the IRS only. It’s essentially a cover sheet that asks for aggregate employer-level data, such as the number of full-time employees per month and the number of 1095-C forms that were issued.

What’s more, the IRS is not the only agency that requires ACA reporting. Some states have enacted laws that mimic the ACA and require annual reports. The method and format of reporting, as well as the deadlines, vary by state. All of them, however, take a similar approach to compliance.

Responding to IRS penalty notices

The IRS generates penalty notices for each tax year based upon the Forms 1094-C/1095-C that were filed or required to be filed by employers, as well as data available from other sources (Form W-2, federal affordability measures, etc.). If any of the forms are late, incomplete or inaccurate, the “reasonable cause” standard applies.

To respond to penalty notices, employers must not only track current-day employee eligibility correctly and completely but also maintain clear and accurate data from previous tax years. The response window is typically 30 to 45 days, during which time employers must provide the aforementioned data, describe potential corrections to the information on file with the IRS and pay any remaining penalties.

What employers need to know about ACA penalties

Under the ACA, two primary types of employer shared responsibility, or "pay or play," penalties exist. If an ALE fails to meet the mandated health coverage requirements, they may be subject to one (but not both) of the following penalties:

Employers not offering coverage

This penalty is triggered if an ALE does not provide minimum essential coverage to at least 95% of its full-time employees and their dependents. If at least one full-time employee receives a premium tax credit for purchasing coverage through the Health Insurance Marketplace, the ALE faces a penalty of $2,000 per full-time employee, excluding the first 30 employees.

Employers offering coverage that is not affordable or does not meet minimum value

This penalty applies when an ALE offers health coverage that either:

- Is not affordable for full-time employees (defined as costing more than a certain percentage of an employee’s income), or

- Does not meet the minimum value standard (the plan pays for at least 60% of covered medical expenses).

If at least one full-time employee receives a premium tax credit through the Health Insurance Marketplace because the employer’s coverage is either unaffordable or lacks minimum value, the ALE faces a penalty of $4,320 per affected employee (2023 rate, adjusted annually).

Explore Use our ACA Penalty Calculator to see your potential penalties

ACA reporting deadlines

Under the ACA, employers must comply with several key reporting deadlines to provide accurate and timely information to employees and the IRS. Here are the main deadlines:

- Form 1095-C to employees: Employers must furnish Form 1095-C to their employees by January 31 of each year, though an automatic, 30-day extension is permanently available. This form outlines the health coverage offered to the employee throughout the previous calendar year.

- Form 1094-C and Form 1095-C to the IRS: Employers are required to file these forms with the IRS annually. The deadline for paper filing is February 28; electronic filings are due by March 31.

- State reporting: Some states have their own reporting requirements that may differ from federal deadlines.

Failure to meet these deadlines can result in penalties from the IRS. For more detailed information, employers should refer to official IRS resources and ensure they stay up to date with any changes in ACA reporting requirements.

Take a proactive approach to ACA penalties

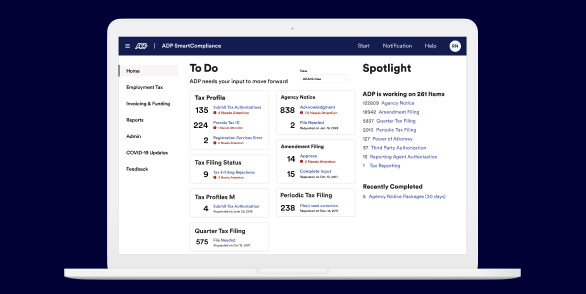

ADP SmartCompliance helps you stay ahead of ACA penalties with real-time compliance insights, seamless integrations, and built-in regulatory adherence.

ACA compliance and group size

ACA compliance varies by group size, with specific requirements for small and large employers:

- Small employers (1-50 employees): Not required to offer health insurance, but must comply with Form 1095-B reporting requirements if they provide coverage.

- Large employers (50+ employees): Must offer affordable health insurance to full-time employees and their dependents or face potential penalties.

Individual/family coverage

ACA compliance for individual and family coverage involves meeting the standards set by the Health Insurance Marketplace. Plans must cover essential health benefits, offer preventive services at no cost, and cannot deny coverage for pre-existing conditions.

Small group coverage

Small group coverage requirements under the ACA include offering plans that meet minimum value and affordability standards. Small employers can use the Small Business Health Options Program (SHOP) to provide coverage.

Large group coverage

Large group coverage requirements mandate that large employers offer affordable health insurance that provides minimum value to at least 95% of their full-time employees and their dependents.

What does a dedicated ACA compliance practitioner do?

A solid compliance strategy, sound preparation and being ready for both the expected and unexpected are necessary to manage ACA compliance successfully. Those tasked with this responsibility generally must:

- Capture data for ACA reports, i.e., plan affordability, offers of coverage, employee acceptance or declination of coverage, etc.

- Align hiring strategies with ACA compliance and classify employees and independent contractors correctly.

- Offer minimum essential health coverage with minimum value to eligible full-time employees, ranging from the initial date of hire to no later than the first day of the fourth full calendar month of employment.

- Track employee statuses regularly to determine if seasonal and variable-hour employees who work enough hours to be considered full-time are offered health benefits in a timely manner.

- Research and respond to ACA IRS penalty notices by the required deadline for penalty reduction or removal, otherwise, the employer is responsible for both the fine and any incurred interest.

Trust ADP for Your ACA Needs

ACA compliance can be complex and stressful, but ADP SmartCompliance has the tools and insights to help you increase accuracy and peace of mind.

Frequently asked questions about ACA compliance

What does ACA stand for?

ACA stands for Affordable Care Act. It was signed into law on March 23, 2010, and took effect in phases beginning in 2014. Reporting to the IRS started during the 2015 tax year.

What does the ACA require of employers?

Businesses that are considered an ALE must provide minimum essential health coverage that is affordable and meets minimum value requirements to at least 95% of their full-time employees (including dependents). Coverage is tracked per FEIN, per employee, per month. Employers also have to fulfill all ACA reporting requirements for the IRS, as well as any applicable states that have similar laws. Those who fail to comply may be subject to ACA employer-shared responsibility payments (ESRP).

What is an ACA penalty notice?

Each year, ALEs must file Form 1095-C and Form 1094-C with the IRS, proving that they complied with the ACA. If either of these forms contains inaccurate information or misses the submission deadline, the employer may receive a penalty notice. In addition, ESRP notices are issued when timely, affordable and appropriate benefits are not offered to full-time employees and their dependents. These notifications include the employees who triggered the ESRP, the incurred penalty – IRS Code Section 4980H(a), (b) or both – and the assessed dollar amounts for each violation.

What health plans are not subject to the ACA?

Certain health plans are exempt from ACA compliance, including but are not limited to:

- Short-term limited duration insurance (STLDI): These plans offer temporary coverage and do not have to adhere to ACA standards for essential health benefits or pre-existing conditions.

- Health care sharing ministries: Members share medical costs among themselves and are not required to comply with ACA regulations.

- Grandfathered plans: Plans in existence before March 23, 2010 are exempt from many ACA requirements, provided they have not significantly changed.

How can I simplify my ACA management?

ADP’s cloud-based SmartCompliance platform can help you proactively avoid penalties and achieve efficient ACA reporting — all from your current payroll, HR or benefits system.

Next steps for managing ACA compliance

From seamless data integration to real-time status visibility, simplify your ACA processes with ADP’s SmartCompliance platform. Our cloud-based solution includes automated eligibility tracking, affordability calculations, and federal and state reporting, all designed to help you avoid penalties.

Learn more about how ADP can help you navigate the complexities of ACA requirements

Want more exclusive business insights like this delivered to your inbox?Subscribe now

This guide is intended to be used as a starting point in analyzing absence management and is not a comprehensive resource of requirements. It offers practical information concerning the subject matter and is provided with the understanding that ADP is not rendering legal or tax advice or other professional services.