California Pay Data Reporting Due by March 31, 2021

California Pay Reporting Portal is open.

California has started to collect Pay Data Reports via an online portal. Private employers with 100 or more U.S. employees (and at least one employee in California) and who are required to file an annual Employer Information Report (EEO-1) pursuant to federal law must submit a pay data report to the California Department of Fair Employment & Housing (DFEH) by March 31, 2021, for the first time and annually thereafter.

To support California's new annual pay data reporting requirement, the California DFEH has created a webpage on pay data reporting (https://www.dfeh.ca.gov/paydatareporting/). The webpage is comprehensive and includes links to the new law (SB 973), the Pay Reporting Portal where employers submit the report, a detailed User Guide, Excel Template, CSV Example, Enforcement Deferral Request, and questions and answers organized by topic.

Technical specifications for the report and step-by-step submission instructions are contained in the 70- page User Guide. The DFEH covers many topics and includes specific examples in the questions and answers, including background information related to the new law … Filing Requirements, Required Content, Pay, Hours Worked, Multi-Establishment Employers, Acquisitions and Mergers, and Spinoffs.

Background

On September 30, 2020, California Governor Gavin Newsom signed into law Senate Bill 973, a new pay data reporting requirement. See our previous updates California Enacts New Pay Data Reporting Requirement and California Issues Information On Its New Pay Data Reporting Requirement.

Covered employers will have to provide California's DFEH with pay data by specified job categories and by race, ethnicity and gender. The reports will be due on an annual basis, starting March 31, 2021, for calendar year 2020.

Pay Data Report

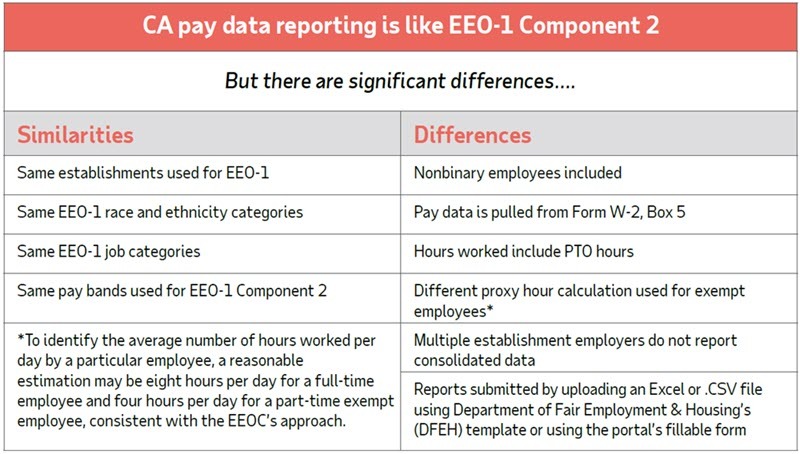

Based on the information provided by the DFEH, the new California pay report is similar to the Equal Employment Opportunity Commission's (EEOC) now-halted EEO-1 Component 2 reporting requirement with some significant differences.

Under the new law, covered employers must submit a pay data report to the DFEH for the prior calendar year (the "Reporting Year").

According to the DFEH, an employer has the requisite number of employees if the employer either employed 100 or more employees in the Snapshot Period chosen by the employer or regularly employed 100 or more employees during the Reporting Year. "Regularly employed 100 or more employees during the Reporting Year" means employed 100 or more individuals on a regular basis during the Reporting Year.

Employees located inside and outside of California are counted when determining whether an employer has 100 or more employees. The questions and answers provide an example of employees located inside and outside of California. An employer that had 50 employees inside California and 50 employees outside of California during the Reporting Year would be required to submit a pay data report to DFEH. An employer with no employees in California during the Reporting Year would not be required to file a pay data report.

Part-time employees, including those who work partial days and fewer than each day of the workweek, are counted the same as full-time employees. Employees on paid or unpaid leave, including California Family Rights Act (CFRA) leave, pregnancy leave, disciplinary suspension, or any other employer-approved leave of absence, are counted.

One difference from the EEOC's current report and prior EEO-1 Component 2 reporting requirements pertains to gender. The EEO-1 report has historically had fields for male and female gender only. By contrast, the California pay data report has three gender category fields: male, female, and nonbinary. Another difference is that DFEH requires employers to use pay data from Form W-2, Box 5 instead of the Box 1 wages used in the EEO-1, Component 2 report. The chart below highlights some of the similarities and differences between California Pay Data Reporting and EEO-1, Component 2.

Penalties and Enforcement Deferral Request

If a covered employer fails to submit a pay data report, the DFEH may seek an order requiring compliance and will be entitled to recover costs associated with seeking the order. There is not an automatic penalty assessed for failing to submit a pay data report.

In light of the COVID-19 pandemic and the fact that pay data reporting is newly required this year, DFEH will consider an employer's request that DFEH defer seeking an order for compliance. The DFEH may grant employers a 30-day extension of the report deadline of March 31, 2021.

To request that DFEH defer seeking an order for compliance (known as an "Enforcement deferral period"), an employer must fill out DFEH's online request form before March 31, 2021, providing the reason for the request and other required information. DFEH provides a link to the online request form at https://www.dfeh.ca.gov/paydatareporting/. An employer that is granted such a deferral will have through April 30, 2021, to file its report with DFEH.

ADP Compliance Resources

ADP maintains a staff of dedicated professionals who carefully monitor federal and state legislative and regulatory measures affecting employment-related human resource, payroll, tax and benefits administration, and help ensure that ADP systems are updated as relevant laws evolve. For the latest on how federal and state tax law changes may impact your business, visit the ADP Eye on Washington Web page located at www.adp.com/regulatorynews.

ADP is committed to assisting businesses with increased compliance requirements resulting from rapidly evolving legislation. Our goal is to help minimize your administrative burden across the entire spectrum of employment-related payroll, tax, HR and benefits, so that you can focus on running your business. This information is provided as a courtesy to assist in your understanding of the impact of certain regulatory requirements and should not be construed as tax or legal advice. Such information is by nature subject to revision and may not be the most current information available. ADP encourages readers to consult with appropriate legal and/or tax advisors. Please be advised that calls to and from ADP may be monitored or recorded.

If you have any questions regarding our services, please call 855-466-0790.

ADP, Inc.

One ADP Boulevard, Roseland, NJ 07068

adp.com

Updated on March 12, 2020